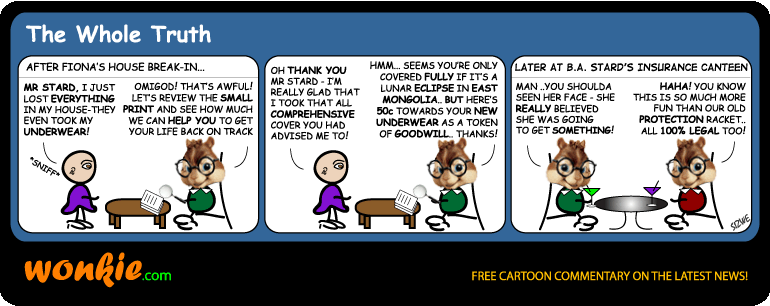

Wonkie remembers watching many old mob movies in which some helpless shopkeeper or other has to pay protection money to a gangster. If he didn’t pay a couple of thugs would promptly come and ruffle up the store, taunt his daughter and threaten him with grievous bodily harm. In countries like South Africa, insurance companies seem to have adopted a similar strategy to the mob.

Consumers are bombarded with messages nurturing fear. They are told that if they do not insure their lives, their cars, household contents, mobile phones, etc. that very many bad things will happen to them. So consumers buy insurance.

Unlike the parallel of the mob however, when insurance companies take your monthly premiums, you can never be sure whether you will be getting the protection that you are paying for. In fact, it is only when disaster strikes, that you will find out whether your policies do in fact give you the cover you need.

Today’s article is by a guest writer – Fiona, who would like to share her recent insurance experience. Please feel free to share your stories, and have a rant or rave about insurance companies in the comments section below.

My car, which was parked in the garage was left on bricks, with damage to the bodywork. The house doors were all destroyed, and light fittings were removed throughout the house. The fitted hob removed. The cupboard door cylinders removed and even the curtains and blinds were taken. I was completely cleaned out!

Of course, we all know crime in South Africa is rife. The process we need to follow is all too familiar: Call 10111 and wait a couple of hours before someone eventually pitches up. They appear to be very surprised that you are a bit edgy. You make a statement, sign it and wait to be advised of the case number. What you’re probably not so familiar with is how your insurance company will handle the matter. Well rest assured this is where you will rest no more.

Today, I am so thankful that my bank persisted I cover the building with Outsurance. This has restored my faith somewhat. The day after the incident, a contractor was at the house to note down the damage. The assessor was in as well and that evening after 7, I was personally notified by the assessor that my claim was approved. I only had to go out and choose my light fittings. The contractor took my keys and co-ordinated the entire claim. I was contacted regularly on progress by email and the claim process was completed in 3 weeks.

In stark contrast, I curse and regret the day I signed up with Glenrand MIB for my car insurance and household contents insurance. It just doesn’t get worse than this: 5 weeks and zero progress. My car is still at the panel beaters – despite regular follow-up calls, the approval to start the repairs was just given 2 days ago. In the meantime, the two weeks car rental option I pay for as part of my premium has run out. The claim consultant dealing with the contents claim is also different to the consultant dealing with the car. To top it off, the contents claim has moved hands twice already.

The required quotations were all provided to the insurance assessor in the first week after the burglary. The assessor’s report was completed at the beginning of week 3. When I called the consultant handling the contents claim at the end of week 3 to find out what the next steps were, I was informed that the claim has now been forwarded to Santam, the underwriter, as it exceeds R200k and they need to approve it. So, I waited. Mid week 4, I called again…and I was then passed on from one person to another until I was finally told that Santam requested that the claim be investigated as it is a huge sum. Yes I agree it’s a huge sum: a huge sum which was specified and agreed to in my contract with Glenrand MIB in 2004. It is a huge sum to which I have contributed towards each month in premiums for years. Premiums paid on time, every time only to receive this atrocious level of service at a time when I need the value of an insurance policy to be real.

More documents, more phone calls, and more investigator interviews later I am now in week 6 of the process and still living out of a suitcase. When I called Glenrand MIB, the claim consultant still lacks the common sense to appreciate why I am being pushy. Of course, she is still pathetically unable to advise whether I would be waiting another day, another week or another month.

If this continues any longer, it looks like I will have no choice but to appeal to the Ombudsman for assistance in resolving the matter and who knows how long that process would take. Given my experience above, I would strongly recommend against getting any insurance policy with Glenrand MIB.

Loading ...

.

.

.

.

Budget Insurance. Had a similar experience. On the day I took out vehicle insurance my wife was involved in an accident with my car. The cause of the accident was not her fault. Damages amounted to over R80 000. Initially the insurance company claimed that beacuase I was the principal driver of the car they will not pay because my wife was driving the vehicle, eventhough she is listed as co driver on the policy. Then the tried to wiggle out by claiming that I provided incorrect information when applying for the insurance. After this I was told that my anger displayed towrads the consultant will be held against me. Only when I threatened with legal action did they agree to settle the claim. I had to pay R4000 in excess and although they have a recovery department/legal department for getting back the excess money after only 2 calls to the 2nd party involved they gave up and claimed that the accident was due to a 3rd party which they were unable to track down. The whole process took 3 months and in that time I used up my car rental option of 2 weeks and then had to travel by public transport.

Budget Insurance was really dissapointing in the way they handled my claim and I would definitely not recommend using them

I am totally surprised, whisked out of my boots as to how our government would allow such (legalled and organised criminal) scam insurance companies who strips every ill-informed citizen of their hard earned cash to waste in this way. This government ought to safeguard its citizens, but no how would you get protection if government get its taxes and the “Party” gets funded indescreetly, why bother with these loathesome citizens. Strip them dry and milk them until they bleed.

Is there any one out there in government to seize the opportunity to save the beautiful country? Perhaps if clever Trevor gets the nod he could do something to stop the rot and decay. God help us all from this prevailing evil that is so well spread in the RSA.

Do not hesitate another second in contacting the ombudsman. That is what he is there for. The moment something begins to become an issue, and all the ducks are in a row, BLAST THEM with both barrels, lady.

My insurance is to keep streetwise, I had my first experience with Sanlam in 1960, when as an apprentice, I paid premiums regularly, and when I needed finance to start a small business the big fat arsehole laughed me out of his office. Little did he know how much I have saved on insurance by not using them.

Standard Bank Insurance Brokers, who are “brokers” of their own underwriting firm, Standard Insurance Limited.

I ham busy with an Ombud claim at the moment (www.osti.co.za) which in itself is a living nightmare. This is for rain damage to a caravan, which was discovered in December 2007, reported in Jan 2008, and they repudiated the claim. (I think because a few months before, they had to pay out for a stolen car claim, but hey – that is me being cynical, now WHY would I be cuynical in our lovely world?)

Any case – ever since SBIB changed their underwriter, the service is RUBBISH!!! I have to submit a new claim now, as our big TV blew the other night, and I am PETRIFIED! As I can just see the issues it will start….

Hello first and for most im going to start off by saying yes I am a financial advisor my main stream is long term investment but I am accredited to do both risk cover as well as short term

Look what happened to all of you is nothing short of rubbish and yes the ombudsman needs to be contacted it helps a lot if you have a record of the person that sold you the policy

One of the biggest problems we currently have is advisors that are chasing com and not helping people or giving them right advice with regard to home and house hold cover if you have compressive cover but your only covered for 50% of your assets (89% of south Africans are only covered for 50%) then can you truly expect your insurance company to cover you 100%

Secondly a lot of people are saying “why should I cover my house or car or this or that when if you go to any first world country and you’re pulled over by cops it’s not your licence they ask you for it’s your insurance details

It was Dr. Adrian Rogers, 1931 that said

“You cannot legislate the poor into freedom by legislating the wealthy out of freedom. What one person receives without working for, another person must work for without receiving. The government cannot give to anybody anything that the government does not first take from somebody else. When half of the people get the idea that they do not have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that my dear friend, is about the end of any nation. You cannot multiply wealth by dividing it.”

And this is truer today then it ever has been

All I can truly say is if you want real help get a real advisor

Make sure your covered to the full value and do not do the South African thing and live 3 times past your personal means and lastly make sure that from the start you know what your covered for and sign for that black and white is worth a million photos

If any one needs help advice or just a review you can contact me on

084 616 8056

nranchod@oldmutualpfa.com

Neil Ranchod

OUTsurance !! They Are Worse insurance company ever …

Every time I see there TV Ads If feel like throwing up !!! .. yes ,, green stuff too …

Thier ads sould Say …

Outsurance .. Insuring that you get nothing out !!

At least , It will be Advertising the truth !! and not Bull Shit !!

Changed to Old Mutual .. and been no problems since then …

Try getting your excess out of Hollard insurance. After 2 years – nothing. At first their recovery ‘specialist’ could get no response from the witnesses. Lo and behold, the first time I phoned the witnesses I got a response from them and passed the info on! Then I physically had to help them get a statement from one of the witnesses, who apparently was rude to their agent. Maybe I should try the small claims court.

I’ve been and am with Santam Assist. Despite me attempting to claim on numerous occassions, I was always given one story or the next. I am now under the belief that Santam Assist colludes with the relevant companies, rather than to satisfying their own client’s needs as I pay them the monthly premiums. Can I open a charge of fraud against Santam, accepting my premiums and still refusing to persue claims on behalf of myself????? Any takers!!!

was thinking of taking a policy but after this i am scared,guess i am better off with a savings account.

That is why my parents only play stokvel’s and family society

Dear Wonks! I couldn’t vote in your survey because it’s awfully one-sided. I’ve been with Auto&General for about 20 years. I only have good things to say about them. They even covered a car’s windscreen before I had it registered in my name and before I even paid a single month’s premium. Man, I’m glad I’m with A&G. Nothing but good from them – and that’s not the only claim.

And if you’re looking for good roadside assistance – pay a sub to the AA. Every time I call because I’ve flattened my battery or run out of petrol, I fall in love with the call centre lady. She even offers me a personal ADT bodyguard when I get stuck.

Perhaps my life is charmed? No, I don’t think so. These two organisations get better and better.

And I don’t work for either, nor am I married to a rep in either, nor am I a cousin.

Keep it up guys.

A very sad incident. Heard somewhere the saying that insurance premiums keep you poor while you are going on paying and when you really need money and makes you dream of a prosperous life that never comes !

I’ve just lost my dad, had him coverved two months before he passed on and this was as accident, the insurance stated that it pays out immediately for an accident but up to htis day I havent had anything from they are sending me from pillar to post and its almost 4 weeks since I made the claim.

Hmmm…think this whole insurance thing is a problem all over the world…even the supposedly first world or let’s say the G8 countries!

It’s how insurance companies and the actuaries they employ make money…and yep it is ridiculous to think you pay all the time just in case something happens and many times nothing does happen…and they know that…they’ve already hedged everything their way and factored it in to make big money off you by insuring people least likely to get sick or this or that to begin with…then when something happens! And for sure it’s the most disgusting when they do it with medical insurance.

That fine print gets you every time…the difference in the G8 countries I guess is you have a place to go complain about them and I figure there are more standards and guidelines and sometimes the issue is addressed…you need to get the message and information out there about that infamous fine print! I’m still not sure if I understand half of mines either! But like Sean I’ve just been living a charmed life thus far…I think I got caught up in some heavenly airstream that was just passing through! 🙂

But really there should be a method to the madness! So Wonkie for sure is doing a good job in getting that message out there! Perhaps one fitting for a country like South Africa on the UK’s and France’s wish list of Outreach Five (O5) or the Plus Five (The outstretched arm of the former colonists…to pull you up…oh how good neighbourly!)

And yep the really sadder part is…I mean either way they (the insurance companies and some of their employees) are already making so much at least in the event of the unthinkable happening pay the people! They would still make huge profits if they did! And it really happens in supposedly developed countries too…many poor sufferers in the US of this!

I’ve always ranked working in such an industry (insurance) as one of the poorest karma jobs out there! Think of the karmic debt… they have making money in sums way more than they need or can spend sensibly based on the sufferring of another man in a way even if it is legal! And it is why I always find it interesting when Muslim friends tell me they dont insure life in Islam…it’s interesting and Islamic banking too…although don’t know how it works…hmm…feel this could be the subject of UCP-Universal Collective Prayer blog post now as it’s on a lull at the end of the Hindu calendar and before the start of the Advent one…hmm…could do…

Now back to the insurance men…They out rank the bankers featured recently on Wonkie pages in people having trouble to sleep at night! 🙂 Although they (the bankers) would come in #2 for sure! I often wonder what is the nastiest legal way to make a living and compare it to my own profession and really insurance men…makes you feel like you’re in a so much nicer job…it always does…

I don’t know if the cartoon is featuring a squirrel’s head which looks so cute by the way…but is also so fitting because bankers and insurance men alike tend to really be like little squirrels (only not as cute looking usually) in the sense of hoarding up all this money…just like squirrels hoard nuts…and they must even display a squirrel like prakriti (nature) …nervous little things twitching about to get more nuts and quickly whisk them away to be hidden and hoarded! 🙂

That squirrel like face with glasses…love it Wonkie! 🙂

Now back to my profession that makes me feel better…but I’d really prefer to be telling Winnie the Pooh like stories (all animals included) to groups of 4 yr olds… 🙂

Insurance compamies all have a clause not to pay out against claims caused by “an act of God”….for some reason they all seem to believe that satan is God! To hell with them!

Hi

I was involved in accident last month and my car has been badly damaged including Airbags. The guy who collided with me left the scene immediately and I called the police who failed to pitch on the scene. I then called my insurance to come to my rescue. They took time till a breakdown(patrol) came to my rescue. I paid R200 of which I knew I will never claim but I was concern about the safety of my car and myself. We took the car to my place, The breakdown(insurance) came to fetch that car. Sunday afternoon I went to collect my belongings from the car-Jack, emergency kit and Tools where missing. I spoke to the guy but he insisted that he did not remove anything from my Car. I told the insurance-they are still quite about it. I submitted all the documents required from me-but till today there is no progress. I was told las week that I must wait for a call from the negotiator. Its towards december, panel beaters might close their workshop before they deal with my car. Right now I am a pedestrian and my so called insurance is dragging their feets.I was told that the report from the tracker company does not match with the time of accident, so they are waiting for another report. The question is:Does the tracker tells them when did the accident happenned or they should investigate or refer to the police statement?. How long must I wait for them?. for me it seems like they are looking for excuses not to fix the car. what are we really paying for?.Somehow insurance are robbing innocent people who has been loyal to them. I think the government must intervene-we need to be protected by law somehow.

Any suggestion:What must I do

Wally – its very frustrating dealing with insurance companies so brace yourself. Would be good if they introduced a turnaround time for claims.

If I had to start on my previous insurance experience I would be here

All night…cut it short it is inexcusable the way that we as customers get

Treated, when will these companies realize that yes we need insurance

And therefore their trade will always be in demand…there is no need for

Their bullish pirate like ways to make a buck…I have a friend who left his employ for a more lucrative position within a insurance firm and after a year he decided to go back to his previous lower paying employer because he could not take it anymore the way that normal everyday people were being gang raped (his words not mine)

By this insurance company…

To Mr. B.A. Stard from Gang rape R Us Insurance…these people you hurt are human they

are us ,everyday hard working people that don’t deserve to be robbed of the peace of

mind that they pay for monthly in the form of premiums…

Wally – its very frustrating dealing with insurance companies so brace yourself. Would be good if they introduced a turnaround time for claims.

We were insured with Sanlam. One month they just stopped taking off the premium. When I queried what had happened, they told me my husband had died. The more I told them they had made a mistake and that he was very much alive, the more they denied that they had made a mistake. Needless to say, we are now insured with someone else.

Dear EMR,

I guess you did the right thing even though you are not off the hook competely. Since then, I am still waiting for their decision,I have been using public transport for two months now.Gosh!! I am getting used to it yet I am paying my Car and insurance installement every month. I asked myself :what am I paying for?Sound rediculous but is true. I am sure I might get the car back sometimes Feb next year only if they have decided to assist me.Wish I can do without insurance you know?.

Wally I know how frustrating this is for you, but as long as they can string you along they will so I suggest you contact the Ombudsman now. The contact details are below

Tel: 011 726 8900

Fax: 011 726 5501

Dear Fiona,

Thanxs very much. I took those numbers from Speak Out (SABC 2 programme)yesterday. I am definately going to call them today.It is indeed very frustrating.I guess evryone must have this number. This thing can happen to anyone.Perhaps Terms and Conditions letters need to be written on top of the page not at the bottom in Italic too. This i s a learning curve for me.

Enjoy your New year Eve-thus goes to everyone who read this page.

i am insured with geico. i just bought an 03 van,126000 miles.paid $5000. when i talked to geico for insurance, she told me about all the choices.

i told her about me being on morphine pills { prescribed }for low back pain that i did not understand.

my sister has power of attorney over such matters. that she would set it up for me and i would call her back and confirm.

she told me that was not allowed, so i went on with getting on my own.

we went through all the choices again. with being a new van, i wanted the best coverage. i ended up with comprehensive.

well, about 3 months later, while i was driving, i went into a diabetic comma.

when i woke up a day and a half later at my friends house, that’s when i learned about the accident myself. i do not remember anything about it at all.

after reporting the accident to geico. they paid $168.00 for a stop sign. that’s it. they said the accident was my fault.

they explained to me again what comprehensive was again.

now why would i be worried about a tree falling on my van. i am more worried about getting hit on the road. { so much for the caveman doing it }

i think the sales person had mislead me all the way. that’s why my sister does that for me. at the start they told me the conversation was going to be recorded.

when i told them to go back and listen to it, she tells me that they only keep the recordings more than 30 days. now how can i prove my case?

now they tell me that it’s in the supervisors office, that they will let me know what will happen. that has been 5 months ago.

they tell me it’s a buyer beware type of deal.

what i want to know is, do i have a legate case, or should i let it go?

This is such a great post and seems to have touched quite a nerve 🙂

no better insurance company than standard bank ins. i have had 4 claim sin 2 yrs…so far so good..brilliant and fair premiums..just never accept a premium increase on vehilcles as thye devalue quarterly.phone them every 3 months and see how the premiums drop..keep up the excellent work std bank…

I’ve just lost my dad and my mum was all alone. She is 80 years old and lives on her own but she also spends a lot of time with me in Gauteng. She lives in Durban. In December she had her house painted. About 2 months ago we noticed the paint was peeling off ,I then had a look at the awlls and noticed it was damp so i notified Glenrand who she is insured with. They have been payinf insurance for the past +-40 years and hardly claimed.

Glenrand came back to me stating that this was too old and could not sort out the claim.

so what do I do now???

Pantaenius Yacht Insurance.

I was fully insured with this “organisation” for over eight years before i made a claim. After i sank and the boat was destroyed they just stated that the boat was unseaworthy would not pay. After i threatened legal action they offered a max of 50% of the claim which would have not even paid for a mast and new electronics- let alone a new motor, complete interior of the boat, computers, clothing, new sails etc.. I rejected the offer as the insult that it was. Even if they had paid in full it would never have covered the damage. Everything was destroyed because it took them so long to get the boat out of the water. Even Pantaenius’ expert maritime advisor stated that they should pay in full but that was not how they do business. They prefer to go to court because most people cannot afford the costs or want to bother with such… (there were witnesses there to this).

I now mention this experience to all other people with boats and know at least 20 cases where they have refused to pay. They of course have very expensive advertising and pay small claims so as to try and make a name for themselves but when it involves real money this would appear to be a set policy.

A lot of major sailing web communities have advertising from Pantaenius and negative comments about them have often just disappeared or the author has been banned. Wow nice.

Needless to say i do not recommend Pantaenius Yacht insurance, well not for insurance anyway….

A had the worst experience with auto&general insurance how they handled the accident claim on me and my wifes car! We didn’t get the service that was promised! Even after car was fixed through autobody works and panelbeaters port elizabeth, da car is not properly repaired! We refused to take it back! No response from insurance to take care of our complaints! We send u guys a fax to help us in our dispute fax was send to email! Markwell/mariane williams. [contact details removed by moderators] We got hope in speak out to resolve our dispute.